In a recent development that has sent shockwaves through the banking sector, the Bank of Ghana has announced the suspension of two prominent financial institutions, Fidelity Bank and First National Bank, for a period of one month. This unprecedented move has raised several questions and concerns among customers, investors, and industry experts. In this article, we will delve into the details of the suspension, its implications, and what it means for the affected banks and the Ghanaian banking industry as a whole.

Bank of Ghana Suspends Fidelity Bank and First National Bank for One Month

The Bank of Ghana, the country’s central bank, has taken the decision to suspend Fidelity Bank and First National Bank for a period of one month. This decision comes after a thorough review of the banks’ operations, financial health, and compliance with regulatory requirements. The suspension is a result of serious infractions identified by the Bank of Ghana, which include violations of banking regulations, non-compliance with anti-money laundering measures, and inadequate risk management practices.

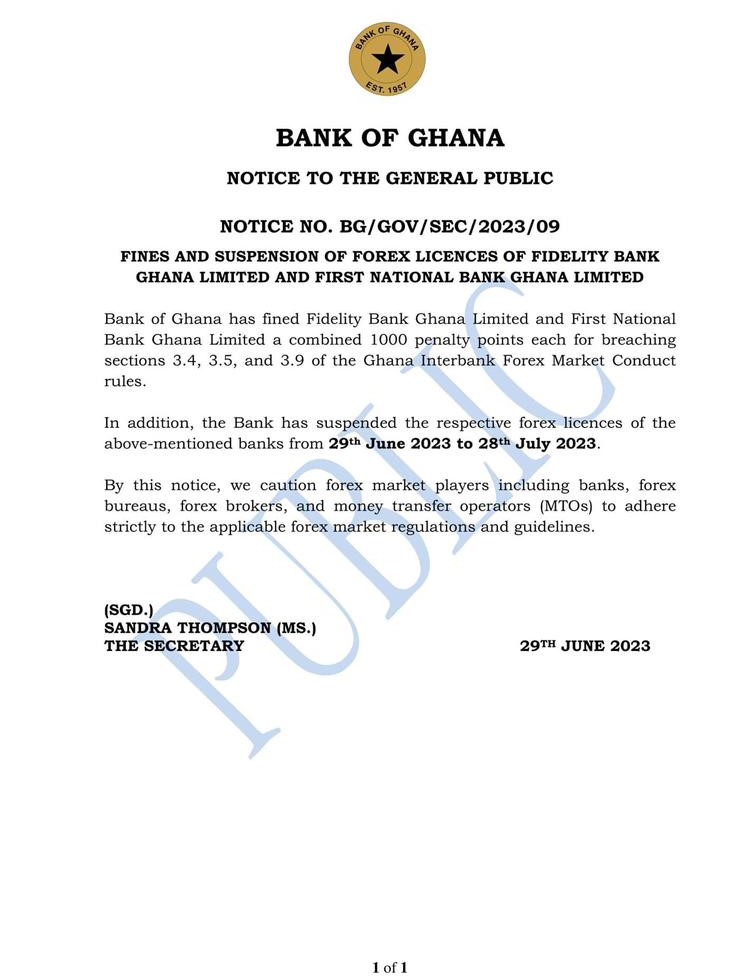

To compound matters, the Bank of Ghana has fined Fidelity Bank Ghana Limited and First National Bank Ghana Limited a combined 1000 penalty points each for breaching sections 3.4, 3.5, and 3.9 of the Ghana Interbank Forex Market Conduct rules. In addition, the Bank has suspended the respective forex licenses of the above-mentioned banks from 29th June 2023 to 28th July 2023. This further underscores the gravity of the violations committed by the banks.

This move by the Bank of Ghana is aimed at sending a strong message to the banking industry, emphasizing the importance of adherence to regulatory guidelines and best practices. It serves as a reminder that financial institutions must operate with utmost transparency, accountability, and integrity to maintain public trust and confidence.

Implications of the Suspension

The suspension of Fidelity Bank and First National Bank has significant implications for both the banks and their stakeholders. Let’s take a closer look at some of the key implications:

- Financial Impact: The suspension is likely to have a substantial financial impact on the affected banks. During the suspension period, Fidelity Bank and First National Bank will be unable to conduct regular banking operations, including accepting deposits and granting loans. This will result in a loss of revenue and potential reputational damage for the banks.

- Customer Confidence: The suspension may shake customer confidence in the affected banks. Customers may have concerns about the stability and reliability of their financial institutions, leading to potential withdrawals of deposits and a shift to other banks.

- Regulatory Scrutiny: The suspension highlights the increased regulatory scrutiny faced by financial institutions. It serves as a reminder to all banks to ensure strict compliance with regulatory requirements and implement robust risk management practices.

- Industry Reputation: The suspension of two prominent banks can impact the overall reputation of the Ghanaian banking industry. It underscores the importance of maintaining high standards of governance, risk management, and compliance across the sector.

By this notice, we caution forex market players including banks, forex bureaus, forex brokers, and money transfer operators (MTOs) to adhere strictly to the applicable forex market regulations and guidelines. The Bank of Ghana has taken decisive action against Fidelity Bank and First National Bank, and it is crucial for all market participants to learn from this incident and prioritize compliance.

FAQs about the Bank of Ghana’s Suspension

- What are the reasons behind the suspension? The suspension of Fidelity Bank and First National Bank is a result of serious infractions identified by the Bank of Ghana, including violations of banking regulations, non-compliance with anti-money laundering measures, and inadequate risk management practices.

- How long will the suspension last? The suspension will be in effect for a period of one month, during which Fidelity Bank and First National Bank will be unable to conduct regular banking operations.

- What impact will the suspension have on customers? Customers of the affected banks may experience disruptions in banking services during the suspension period. It is advisable for customers to stay informed and seek alternative banking options if necessary.

- Will the suspension affect the stability of the banking sector in Ghana? While the suspension may create temporary instability, it ultimately serves as a measure to ensure the long-term stability of the banking sector by promoting adherence to regulatory guidelines and best practices.

- What steps can the affected banks take to address the issues raised by the Bank of Ghana? During the suspension period, the banks must undertake a comprehensive review of their operations, strengthen their risk management practices, and implement corrective measures to address the issues identified by the Bank of Ghana.

- How will the suspension impact the affected banks’ relationship with customers and investors? The suspension may erode customer and investor confidence in the affected banks. Rebuilding trust will require transparent communication, swift resolution of issues, and a commitment to implementing necessary reforms.

Conclusion

The suspension of Fidelity Bank and First National Bank by the Bank of Ghana has brought to the forefront the importance of regulatory compliance and sound governance in the banking industry. This decisive action, coupled with fines and forex license suspensions, sends a clear message that the Bank of Ghana will not tolerate violations of banking regulations.

It is crucial for the affected banks to take this opportunity to rectify the identified infractions, strengthen their operations, and rebuild trust among their customers and investors. The Ghanaian banking sector, as a whole, must learn from this incident and work towards maintaining the highest standards of integrity and professionalism.

By cautioning all forex market players to adhere strictly to the applicable regulations and guidelines, the Bank of Ghana aims to ensure a more robust and compliant financial ecosystem.